In tight markets, mismatched price and quality erode trust fast and quietly depress repeat purchase rates. Matching price to quality means aligning what something costs with what it delivers, then signaling that alignment clearly across packaging, service, and communication.

Matching price to quality starts with what buyers value, not internal cost spreadsheets, then uses disciplined pricing rules so the number on the tag feels fair and defensible.

In practical terms, higher prices should be attached to demonstrably better materials, performance, or service scope, while accessible prices should avoid implying a fragile build or cut corners.

Why Price and Quality Must Align

Price frames expectations before anyone touches the product. If a number signals premium while the experience signals mid-tier, frustration grows and churn follows.

The inverse also hurts, since suspiciously low prices can imply poor reliability or hidden compromises, which drives extra scrutiny and lower satisfaction scores. Reliable alignment anchors merchandising, reviews, and referral behavior.

Across categories, perceived fairness builds margin headroom, reduces discount dependency, and stabilizes demand across cycles. Strong alignment also simplifies roadmap decisions because feature tiers and materials choices map cleanly to pricing tiers.

Current Consumer Signals

A short reading of recent shopper behavior helps set direction, particularly across inflationary periods and promotional peaks.

- Many shoppers report price sensitivity increasing, although quality signals remain decisive for big-ticket or long-use items.

- Deals draw store traffic during seasonal peaks, while quality and convenience drive online shortlists once basic price checks pass.

- Loyalty mechanics are most effective when the underlying price and value story already feels credible.

- Transparent fees, clear warranties, and realistic delivery windows consistently score as quality cues, even when prices trend higher.

Core Concepts: Price Perception and Price Positioning

Price perception is the subjective reading of a price level relative to what the buyer believes a product is worth. It is shaped by prior experiences, category norms, and visible signals such as materials, packaging, and after-sales support.

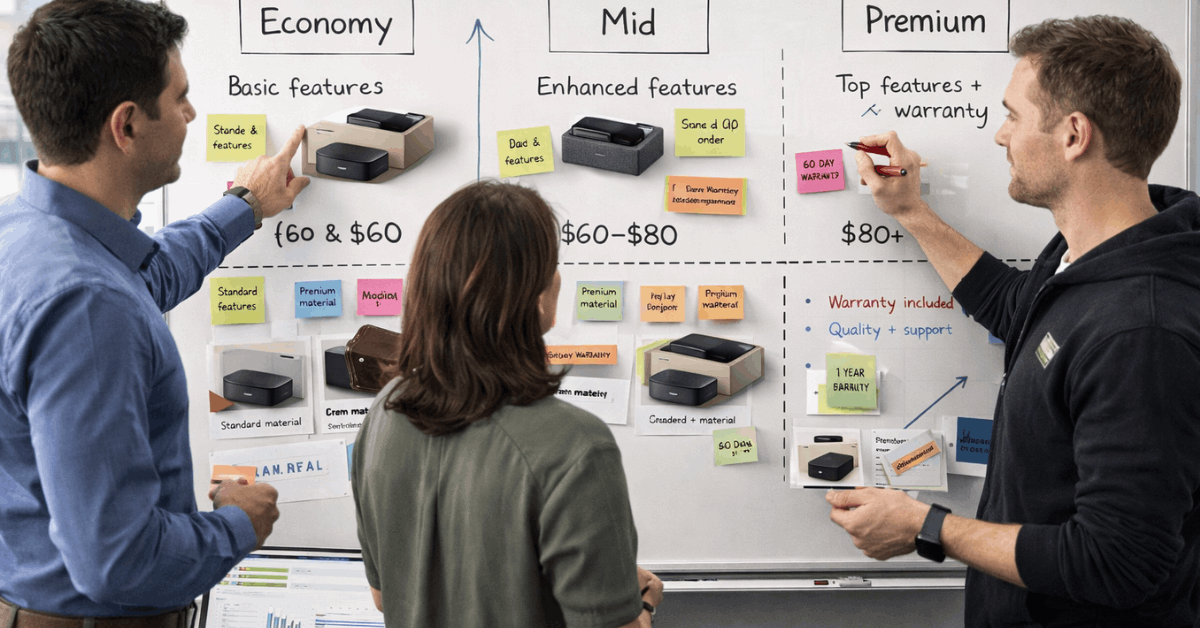

Strong price perception means the number feels fair for the benefits delivered. Price positioning is the deliberate place a brand selects on the market map, such as economy, mid, or premium.

Confident price positioning ties each tier to a crisp value proposition, consistent naming, and repeatable proofs. Both concepts move together, since everyday signals either reinforce or erode the intended position.

Signals That Anchor Perceived Quality

Material specs, fit and finish, and durability evidence do heavy lifting for physical goods. For software and services, uptime, response time, onboarding speed, and outcome proofs carry similar weight.

Packaging, clear documentation, and no-surprise returns policies further stabilize expectations. Even small touches, such as accurate weight and dimension disclosures or exact ingredient lists, protect perception when shoppers compare side-by-side.

Brand identity matters as well. A consistent visual system, credible endorsements, and simple plan names telegraph confidence. Frictionless checkout, clean invoices, and transparent taxes or fees reduce cognitive load, which supports price acceptance.

A Practical Framework For Matching Price To Quality

A brief, repeatable flow keeps teams aligned, whether launching a new line or re-tiering an existing one.

- Map buyer outcomes first, then quantify willingness to pay using surveys, interviews, and behavioral data tied to Voice of Customer signals.

- Build a value ladder, link features and service levels to each rung, then set value-based pricing guardrails.

- Use competitive benchmarking to flag outliers, then test price points in small, instrumented pilots across channels.

- Align cues with the chosen tier, including materials, packaging, service levels, and content that credibly demonstrates quality.

- Monitor post-purchase sentiment, returns, and support volume to confirm that perceived value aligns with the paid tier.

Pricing Strategies and When They Fit

A compact table helps decide which tactic belongs to each offer while keeping risks visible.

| Strategy | When It Fits | Primary Signal | Main Risk |

| Value-based pricing | Clear outcome proofs, measurable benefits | Fairness and ROI | Misread willingness to pay |

| Premium pricing strategy | Scarcity, craftsmanship, status cues | Exclusivity and superiority | Perceived arrogance without proof |

| Competitive pricing | Mature, price-searched categories | Parity and predictability | Margin erosion spiral |

| Dynamic pricing | Volatile demand, perishable capacity | Flexibility and transparency | Fairness backlash if opaque |

| Freemium or bundles | Feature-layered software or accessories | Choice and progression | Cannibalizing paid tiers |

Tactics That Build Trust and Reduce Expectation Gaps

Price-quality alignment becomes durable when the rationale is simple and visible. Short product pages that show test results, certification marks, or third-party ratings help buyers quickly assess value. For services, publish clear service level targets, escalation paths, and coverage scopes.

Price-matching guarantees work when operational discipline keeps claims low and when the brand already communicates competent quality.

Price-quality signaling is real in luxury and enthusiast segments, although it must be backed by workmanship or performance proofs. Charm pricing can nudge perception in commoditized aisles, while round numbers often suit premium tiers that emphasize clarity and confidence.

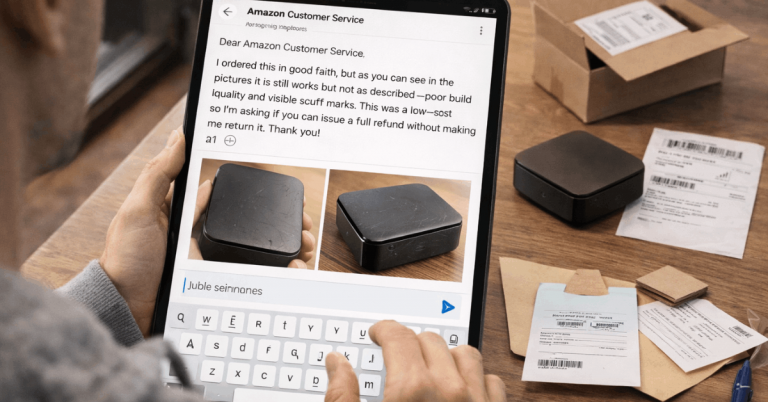

Common Pitfalls and How To Prevent Them

Teams see the same traps recur, particularly during promotions and launches.

- Overpricing thin quality: premium numbers without premium materials or service depth quickly trigger rip-off perceptions.

- Underpricing strong quality: low numbers on high-performing items invite skepticism and train customers to wait for markdowns.

- Incoherent promos: blanket discounts flatten perceived quality tiers and confuse long-term positioning.

- Opaque fees: drip pricing breaks trust and inflates support contacts, even when the base price is competitive.

- Static pricing during fast shifts: slow reactions to costs or competitor moves leave prices out of sync with buyer expectations.

Measurement: Does Pricing Change Satisfaction and Retention

Price fairness strongly correlates with satisfaction because it sets the baseline for perceived value. Studies in consumer behavior consistently show that fairness perceptions depend on transparency, category norms, and personal expectations.

When price and experience align, Net Promoter Score and repeat purchase rates tend to rise, since buyers feel respected and well served. A useful habit is pairing price tests with post-purchase surveys and support metrics.

Rising complaint rates about surprise fees or quality mismatches signal misalignment quickly. Falling return rates and fewer what-is-included questions usually confirm that positioning, signaling, and delivery are working together.

Examples and Mini Snapshots

Luxury watches illustrate scarcity plus craftsmanship, turning high prices into a feature rather than a barrier. If those brands cut prices without changing signals, existing owners might feel diluted, and new buyers could question authenticity.

Consumer electronics provide a broader case: premium flagships command higher list prices while justifying them through longer update windows, ecosystem benefits, and demonstrable performance.

Accessible everyday items sell on reliable quality, clear sizes, and consistent prices, while premium sub-lines rely on visible ingredients or sustainability proofs to justify a higher tier. In software, layered plans allow teams to scale as needs grow, allowing price positioning to evolve without disrupting existing users.

Operational Guardrails For Promotions and Markdown

Promotional depth should vary by quality tier to keep perception intact. Clearance activity on a premium line needs a rationale, such as end-of-season colorways or prior-generation models, while core builds remain protected.

In categories where price perception hinges on a small set of highly shopped items, keep those items competitive and let differentiation carry the rest of the basket.

Clear language stabilizes the experience during markdown windows. Publish what is included, what is excluded, and how warranty and support work at discounted prices. That clarity allows lower numbers to attract attention without eroding the long-term signal of quality.

Execution Checklist For The Next 90 Days

Teams moving from intuition to structure can use a short, rotating plan.

- Finalize the value ladder and attach measurable proofs for each tier, then align naming and packaging.

- Instrument price tests across three channels, track conversion, returns, and post-purchase sentiment, then iterate.

- Refresh product pages to foreground materials, test data, certifications, and service scope, then prune filler.

- Implement Voice of Customer routines that tag feedback by tier and feature, then feed learning into the roadmap and pricing.

- Stand up price-matching guarantees where appropriate, then define guardrails to keep abuse low and trust high.

Technology That Supports Alignment

Modern pricing stacks model willingness to pay, competitor movements, and elasticity under uncertainty. Clean inputs matter more than fancy algorithms, so teams should prioritize high-quality product data, consistent attributes, and resolved duplicates.

Rule engines can protect floors and ceilings, while alerting to outliers created by dynamic pricing or rapid cost swings. Analytics should sit close to merchandising and support.

When returns spike for a single SKU after a price move, investigate materials, labeling, and reviews before treating the issue as purely promotional. When sentiment rises after a small price increase that funds better service, document the lesson and repeat it where conditions match.

Last Thoughts

Strong alignment between what is paid and what is delivered is the fastest route to durable satisfaction and margin resilience. Clear signals, disciplined tests, and straightforward language help prices feel fair at every tier.

The outcome is a product line that speaks plainly about value, earns trust on day one, and continues to earn it over months of use.